The Monetary Authority of Singapore (MAS) has just announced that the new set of Singapore coins will be introduced in mid-2013. Belonging to the Third Series since independence, the designs of the new coins feature five of Singapore’s most iconic landmarks: the Merlion, Port of Singapore, Changi Airport, HDB Flats and the Esplanade.

MAS was given the right to issue Singapore dollar notes and coins in October 2002 after its merger with the Board of Commissioners of Currency, Singapore (BCCS). Previously, the BCCS, set up in 1967 under the Currency Act, was the main body of currency issuance. Before the circulation of the first series of Singapore notes and coins, Singapore had been using a common currency issued by the Board of Commissioners of Currency, Malaya and British Borneo between 1953 and 1967. The new currency system of Singapore signified the full independence of the nation from the British.

The Singapore Mint

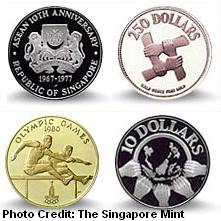

In 1968, to maintain a high standard of precision engineering and security, the Singapore Mint was established by the former Minister for Finance Dr Goh Keng Swee for the minting of Singapore coins. The following year, it issued Singapore’s first commemorative coin to celebrate the 150th year of the founding of Singapore (in 1819). It was a 22-carat gold coin that featured the Raffles Lighthouse.

In 1968, to maintain a high standard of precision engineering and security, the Singapore Mint was established by the former Minister for Finance Dr Goh Keng Swee for the minting of Singapore coins. The following year, it issued Singapore’s first commemorative coin to celebrate the 150th year of the founding of Singapore (in 1819). It was a 22-carat gold coin that featured the Raffles Lighthouse.

The high quality of the Singapore Mint became internationally well-known in the seventies. Other countries and regions, such as the Philippines, Nepal, the Western Samoa, and later Macau, Cook Islands and Brunei, approached Singapore for the minting of their own circulation coins. In 1975 and 1977, two sets of commemorative coins were launched to mark the 10th year anniversaries of Singapore’s independence and its membership to the Association of the Southeast Asian Nations (ASEAN) respectively.

The high quality of the Singapore Mint became internationally well-known in the seventies. Other countries and regions, such as the Philippines, Nepal, the Western Samoa, and later Macau, Cook Islands and Brunei, approached Singapore for the minting of their own circulation coins. In 1975 and 1977, two sets of commemorative coins were launched to mark the 10th year anniversaries of Singapore’s independence and its membership to the Association of the Southeast Asian Nations (ASEAN) respectively.

Other than the core business of coin minting, the Singapore Mint also took on other businesses such as minting of military medals and memorabilia for private companies. Entering privatisation in the eighties, the Singapore Mint began to focus in production, design, packaging and marketing.

More commemorative coins were launched to mark the important milestones in the progress of Singapore, such as the official opening of the Changi Airport (1981), the completion of the Benjamin Sheares Bridge (1982), 25th anniversary of HDB (1985) and the success of MRT (1989).

One popular collection of commemorative coins introduced was the lunar coin series, first started in 1981 with the Year of the Rooster coin. Since then, it had become one of the longest series, with an animal of the Chinese Zodiac (Rat, Ox, Tiger, Rabbit, Dragon, Snake, Horse, Goat, Monkey, Rooster, Dog and Pig) designed, minted and sold to the public every year.

The Singapore Coins – Marine Series

Singapore’s first set of coins was launched in 20 November 1967, about five months after the introduction of its first set of dollar notes. The denomination of the coins ranged from 1-cent to $1, with designs of public housing (1-cent), snake-bird (5-cent), sea horse (10-cent), swordfish (20-cent), lionfish (50-cent) and a Singapore-styled lion ($1).

In 1971, the Singapore Mint also issued a limited edition of a FAO 5-cent coin to the public. It was to mark Singapore’s participation in the Food and Agricultural Organisation (FAO), and the coin was designed with a fish and wordings of “INCREASE PRODUCTION” and “MORE FOOD FROM THE SEA”. Made of aluminum, the 1.24g coin was even lighter than the normal 5-cent coins, even though it was almost as large as the 20-cent coin. Due to its limited quantity, light weight and a large size for a 5-cent coin, many people thought it was a counterfeit coin.

The Singapore Coins – Floral Series

In December 1985, the Singapore Mint introduced Singapore’s second coin series. New 5-cent to 50-cent coins were issued with designs of flowers and plants on the faces. The fruit salad plant, star jasmine, powder-puff plant and the yellow allamanda were chosen for the 5-cent, 10-cent, 20-cent and 50-cent coins respectively.

The 1-cent and $1 coin of the ‘flora series’ were issued only almost two years later, in September 1987, with face designs of Singapore’s national flower Vanda Miss Joaquim (1-cent) and the periwinkle ($1). The $1 coin was also the first design of a Singapore coin with an octagonal frame, which led to the famous feng shui and bagua rumours.

The current ‘flora series’ coins are expected to be phased out by 2017, replaced by the new third series coins. Interestingly, the design of an octagonal frame is retained on the new $1 coin.

The Singapore Notes – Orchid Series

The ‘orchid series’ Singapore dollar notes were the first set of currency notes issued by Singapore. Six denominations of $1, $5, $10, $50, $100 and $1,000 were launched first, in June 1967, followed by $25, $500 and $10,000 denominations in August 1972 and January 1973.

Various types of orchids were chosen as designs for the faces of the ‘orchid series notes, whereas the back designs consisted of public housing ($1), Singapore River ($5), four grasped hands ($10), Supreme Court building ($25), Clifford Pier ($50), Singapore waterfront ($100), Government Offices ($500), Victoria Theatre ($1,000) and The Istana ($10,000).

The $10 design had perhaps the most iconic design, with its striking red background and the four grasped hands that represents the racial harmony and unity among Singapore’s four main races. It signified the importance of a stable society that was much needed in the sixties just after the country’s independence.

Till date, the $25 ‘orchid series’ note was the only denomination of its kind in Singapore currency.

The Singapore Notes – Bird Series

Between August 1976 and February 1980, Singapore’s second note series were issued. The ‘bird series’, as its name suggested, involved a range of bird designs on the faces on the dollar notes, including kingfisher, sunbird, oriole and eagle.

At the back, there were designs of National Day Parade ($1), cable cars ($5), Garden City ($10), Changi Airport and Concorde ($20), school music band ($50), ethics group dancers ($100), oil refinery ($500), container terminal ($1,000) and the Singapore River ($10,000). The new back designs of the ‘bird series’ notes demonstrated the rapid progress enjoyed by Singapore in the seventies.

The previous $25 denomination note of the ‘orchid series’ was replaced by a new $20 denomination ‘bird series’ note.

The Singapore Notes – Ship Series

The third series of the Singapore dollar notes was introduced between October 1984 and August 1989. Boats and ships ranging from tongkangs and twakows, used to be commonly found at the Singapore River in the eighties, to the huge cargo container “Neptune Garnet”, were used for the face designs of the dollar notes.

The $20 denomination was disused in the third series, but a new $2 denomination was added to the ‘ship series’ in January 1991. Designed with reddish orange background, the new $2 dollar note caused confusion among the public, due to the similarity in the colour with the $10 note. In December 1991, a purple variation of the $2 note was issued.

The likes of Changi Airport, Benjamin Sheares Bridge, PSA Container Terminal and Sentosa Satellite Earth Station were featured in the back designs of the third series notes to reflect the economic success of Singapore in the eighties.

In 1990, Singapore issued its first polymer dollar note to celebrate its 25 years of independence. It was only two years after Australia became the first country in the world to introduce polymer currency. The $50 polymer notes, however, were for commemorative purpose and printed in limited quantities. It was not until the mid-2000s before polymer currency was widely used for circulation in Singapore.

The Singapore Notes – Portrait Series

In conjunction with the Millennium celebration, Singapore issued its fourth and current series of dollar notes in September 1999. Known as the ‘portrait series, it features the portrait of Singapore’s first president Encik Yusof bin Ishak (1910-1970) on the face designs of every denomination.

Some significant changes made to the new series are the discontinuation of the $1 dollar note and the introduction of polymer currency. By the mid-2000s, the polymer notes in the denomination of $2, $5 and $10 portrait series notes became available for circulation. The higher denomination, however, remained printed in paper forms.

The Early Currency

When Sir Stamford Raffles established Singapore as free port in 1819, trading flourished rapidly, with the Chinese, Indian, Arab and European merchants preferring to deal mainly in the Spanish and Mexican silver dollars due to their high silver content.

When Sir Stamford Raffles established Singapore as free port in 1819, trading flourished rapidly, with the Chinese, Indian, Arab and European merchants preferring to deal mainly in the Spanish and Mexican silver dollars due to their high silver content.

The first coin in circulation in Singapore was minted in 1824 by the Calcutta Mint of India. The valuation was fixed at 1/3-cent and 1/30-dollar, but the quality of the coins was poor, resulting in a brief circulation before they were gradually phased out.

The first coin in circulation in Singapore was minted in 1824 by the Calcutta Mint of India. The valuation was fixed at 1/3-cent and 1/30-dollar, but the quality of the coins was poor, resulting in a brief circulation before they were gradually phased out.

After the establishment of the Straits Settlements in 1826, the British East India Company, which also administrated the Indian subcontinent, enforced the Indian silver rupee as the sole legal currency in Singapore and Malaya. Meanwhile, in the 1850s, private banks such as Asiatic Banking Corporation, Oriental Bank Corporation, Chartered Mercantile Bank of India, London & China and Hong Kong and Shanghai Banking Corporation (HSBC) began to issue their own currency notes. These were the first paper currency used in Singapore.

In April 1867, the Straits Settlements were placed under direct British rule as the Crown Colony. The Indian silver rupee was abandoned and replaced by the silver dollars as the legal tender currency. This lasted until 1903 when the standardised Straits Dollars were issued.

In April 1867, the Straits Settlements were placed under direct British rule as the Crown Colony. The Indian silver rupee was abandoned and replaced by the silver dollars as the legal tender currency. This lasted until 1903 when the standardised Straits Dollars were issued.

The British Malayan Currency

In October 1938, the Commissioners of Currency, Malaya was established. British financial administrator Sir Basil Blackett (1882-1935) had earlier published a report, later known as the Blackett Report, on the feasibility of the Straits Settlement currency.

Legalised by the government of the Straits Settlement, the Malay states and Brunei, the board started issuing a common currency for circulation within Malaya and Brunei. The currency system would later extend to Sarawak and North Borneo in 1953.

The Banana Notes

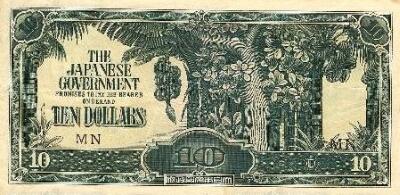

The Japanese forces began their invasion of Malaya at the end of 1941, and by February 1942, the conquest of the entire peninsular was completed with the surrender of Singapore. At the start, the Japanese invasion currency, officially known as the Southern Development Bank Notes, were serial-numbered dollar notes in denominations of $1, $5 and $10, and were intended to be circulated together with the existing British Malayan currency.

After the Japanese strengthened their foothold in Malaya, the British Malayan currency were forced to be obsolete, and replaced by new Japanese notes ranging from 1-cent to 50-cent. In the later years of the Second World War, the Japanese authorities printed large amount of money to support their military causes. Serial numbers were abandoned, resulting in hyperinflation and steep depreciation of the currency.

By August 1945, the Japanese invasion currency became worthless due to an imminent surrender of Japan. Tens of thousands of locals rushed to dump their money in exchange of the old currency, provisions or other assets. Many became bankrupt, while others who had secretly kept their old Malayan money benefited by the return of the British.

By August 1945, the Japanese invasion currency became worthless due to an imminent surrender of Japan. Tens of thousands of locals rushed to dump their money in exchange of the old currency, provisions or other assets. Many became bankrupt, while others who had secretly kept their old Malayan money benefited by the return of the British.

The Japanese invasion currency used in Malaya, Singapore, Sarawak, North Borneo and Brunei would later popularly known as the banana notes, due to the designs of banana trees on the face of the $10 dollar note.

The Common Currency

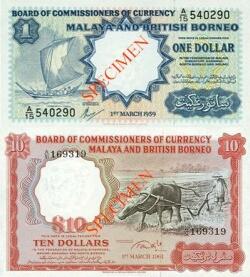

With Sarawak and North Borneo established as British crown colonies after the Second World War, the Board of Commissioners of Currency, Malaya, was restructured in 1952 to become the Board of Commissioners of Currency, Malaya and British Borneo, and was given the sole right to issue dollars and coins for Malaya, Singapore, Sarawak, British North Borneo and Brunei.

Bearing the image of the British monarch Queen Elizabeth II, the common currency lasted until 1967 and signified the British influence over Malaya and Borneo, even though the Federation of Malaya achieved independence in 31 August 1957.

In a bid to demonstrate independent sovereignty and to welcome the new era, the Malayan government introduced a new currency design in March 1959.

In a bid to demonstrate independent sovereignty and to welcome the new era, the Malayan government introduced a new currency design in March 1959.

In June 1967, the currency used commonly by the Federation of Malaysia, Singapore and Brunei was discontinued with each country’s establishment of its own currency system, although the common currency remained legal tender for a further two years. The Board of Commissioners of Currency, Malaya and British Borneo, finally ceased its operation in November 1979.

The Interchangeability Agreement

The Interchangeability Agreement

In order to boost trade relations and economic ties, an Interchangeability Agreement was adopted by the three countries, in which the currencies of the three countries were allowed to interchange at a fixed rate.

This tripartite agreement, however, lasted until 8 May 1973 when Malaysia decided to opt out, but Singapore and Brunei continued the agreement till present day.

To mark the 40th anniversary of the Interchangeability Agreement between Singapore and Brunei, a set of commemorative $20 dollar notes was launched in 2007.

Published: 24 February 2013

Updated: 30 May 2021

Discover more from Remember Singapore

Subscribe to get the latest posts sent to your email.

Was looking at my coins when I found a pair of German-Singapore Institute open house tokens dated 1984

Apparently, the German-Singapore Institute (GSI), together with France-Singapore Institute (FSI), Japan-Singapore Institute (JSI) and Precision Engineering Institute (PEI) were local institutes of technology in the 70s and 80s.

They were transferred from the Economic Development Board (EDB) to part of the Nanyang Polytechnic’s School of Engineering when it was established in 1992.

Not sure how I got these tokens though…

A beautiful blog! Inspiring and historically interesting, especially for someone like me who hasn’t grown up in Singapore yet loves to retrace the good old days…

Well written……………I’ve a blog on current South East Asian to Straits currency notes and their history, come pay a visit. http://clement-oddsends.blogspot.com/

What a big collection you have, Clement

I like your detailed descriptions of the ‘orchid series’ (http://clement-oddsends.blogspot.sg/2011/07/singapore-orchid-series-currency-notes.html)

It’s my favourite set of Singapore currency… but I don’t think I can ever add the $500, $1,000 and $10,000 (!) to my collection

Is there anyone interested 10,000 Singapore Orchid Series ? Characteristic features is appropriate from MAS instruction ( 2 security threads ) and not REPRODUCTION.

Detail :

– It has watermark

– The orchids was shine in ultraviolet

– Text of “MAJULAH SINGAPURA” was arise if in touched

– It has 2 security threads

– In thread has “KING SINGAPORE” text

– The red box seal was shine in ultraviolet

IDENTIFICATION ABOVE WAS IMPOSSIBLE TO BE FALSIFIED

Contact :

email : nationaltreasure23@gmail.com

An interesting article on ringgits and dollars in Chinese dialects

(Source: MyPaper)

This $25 Singapore note was issued in 1996 to commemorate the 25th anniversary of MAS… Only 300,000 pieces were issued to public

Hai…..saya nak tanya, saya ada ( The Singapore Notes – Ship Series ) 2 doller tapi belom potong lagi, ada 12 note semuanya dalam satu helai yg belom potong. So….saya nak tanyer beza x harga nya dengan yang dah potong dengan yg belom potong. Kalau lain…..berapa harga duit yg belo potong.

I have $10,000 orchid series and yusof bin ishak. every 100 sheets it has FDIC certificate. Would you mind to explain how the story about this ? Contact : email : nationaltreasure23@gmail.com

I just found a Singapore 50 cent coin dated 1968 in my jewelry box. Probably worth nothing. Just curious.

Someone left it for good luck.

Hi, I have send an email regarding currency of singapore, its history and all and was wondering if you could help. I send using my school’s account as it is for my school FYP project. Any help that could be given would be appreciated.

Hope to hear from you soon.

Regards

Singapore to stop issuing S$10,000 notes

02 July 2014 CNA

SINGAPORE: From Oct 1, S$10,000 notes will no longer be issued in a move to lower the risk of money laundering, the Monetary Authority of Singapore (MAS) said on Wednesday (July 2). Speaking at the ABS Financial Crime Seminar on Wednesday, MAS Deputy Managing Director Ong Chong Tee said the development of more advanced and secured electronic payment systems has reduced the need for large value cash-based transactions.

Mr Ong added that the discontinuation of the note is not expected to create any major inconvenience. “Existing S$10,000 notes in circulation will remain legal tender, including all notes under the Currency Inter-changeability Agreement with Brunei. However, we expect the stock of such notes to dwindle over time, as worn notes are returned to us and not replaced,” he said.

In his speech, Mr Ong also said MAS plans to launch a public consultation on proposed amendments to its regulatory framework to tighten checks against money laundering and terrorist financing. Proposed amendments include requiring banks to screen customers, tightening the threshold for enhanced measures on cross-border wire transfers, and providing a risk-based approach for “politically exposed persons”, he said.

I have japanese The Banana Notes money ..how much i i selling mine?

Wanbao

01 August 2014

A local collector makes a successful bid of $34,000 in a recent auction for a rare piece of 5-dollar note of the Orchid Series. The dollar note comes with a serial number of A/5 555555.

Hi, I’m looking for $1 coin make in 1996, but I can’t find any. The date jumps from 1995 to 1997, is it because it doesn’t produce coin in 1996 ? Thanks in advance .

Reblogged this on Người Đến Từ Bình Dương.

Hello just Asking..You want Old Coins Singapore..1 Set..1982..WITH CATALOG..and COINS SINGAPURA 5DOLLAR 25YEARS PUBLIC OF HOUSING 1960..LOOK MY PHOTO..SERIOUS BUYER PM ME..+60177767417..TQ..

Purchase Official Note Collection $ 10,000 SGD

http://www.singaporemint.com/trade_post_view.php?id=2364

I have five, five dollar silver coins (uncirculated) with Queen Elizabeth II image on front. What is approximate value of a coin?

Second Separation: Why Singapore Rejected a Common Currency with Malaysia

16 May 2016

The Straits Times

When Singapore separated from Malaysia in August 1965, it continued to use a common currency with Malaysia and Brunei, the Malayan dollar. Issued by the Board of Commissioners of Currency of Malaya and British Borneo, the Malayan dollar was a currency that generations on both sides of the Causeway were accustomed to.

Despite their strained relations, the two governments agreed to discuss how the common currency arrangement could be preserved. Singapore’s Finance Minister Lim Kim San, as early as October 1965, just two months after Separation, had raised the matter of a common currency with his Malaysian counterpart Tan Siew Sin.

Mr Tan authorised the Governor of Bank Negara, Tun Ismail bin Mohd Ali, to initiate discussions with Singapore. Bank Negara’s suggestion was to continue the common currency arrangement, but with it issuing currency for both countries. There could be differences in design to differentiate the currency issued in Malaysia from the one issued in Singapore, though either one would be legal tender in the other.

The other issue that Singapore raised concerned the control and ownership of the reserves, in the first instance, the pool of reserves transferred from the existing currency board.

This, more than the type of monetary system, was a fundamental issue for Singapore: it would only agree to negotiations if there were binding assurances that its reserves would remain under its control and management. Bank Negara understood Singapore’s concern and agreed to modify its original proposals concerning the arrangements for the management of reserves.

Dr Goh was then Defence Minister but was influential in shaping the government’s strategy in the currency talks. He took it on himself to compose detailed memoranda to explain to his Cabinet colleagues the complexities of monetary policy, the implications of the proposals being tabled and the stand Singapore should take.

Far from viewing Dr Goh’s interventions as intrusions on his turf, Mr Lim welcomed them. Old friends from their days at Raffles College – Mr Lim had been best man at Dr Goh’s wedding – they formed a formidable team: Dr Goh the economic theoretician and practitioner par excellence, and Mr Lim the businessman-turned-politician, a “political entrepreneur…who seized opportunities using powers of analysis, imagination, a sense of reality and character”, as Mr Lee was to describe him later.

Significantly, Dr Goh seems to have been the most sceptical among his senior colleagues about the arrangements for the common currency.

Dr Goh felt Singapore should seek two safeguards: First, each government’s reserves should unambiguously be under its own direction. And second, Bank Negara should operate only as an agent of the Singapore government, completely subject to the direction of the Singapore Finance Minister in matters affecting Singapore.

He forecast that these safeguards, though absolutely necessary for Singapore, would be unacceptable to Kuala Lumpur. Singapore should therefore be prepared for a breakdown in the negotiations, he advised.

Still, notwithstanding Dr Goh’s reservations, and somewhat to his surprise, the talks progressed to the point of producing a Final Draft Agreement. It provided for a common currency with the same design except that the Malaysian issue would be designated the “M” series and the Singapore issue the “S” series. The two issues would be legal tender in either country. Each country would control its own issue and the management of its reserves.

In a meeting with his colleagues on July 6, Mr Lee commented that Singapore did not get all the safeguards it had hoped for in the Draft Agreement. He observed that the proposed Agreement was between two unequal parties, for Bank Negara was already an established institution while Singapore had no equivalent central banking machinery. The Prime Minister, however, viewed that the break-up of the Common Currency arrangement would forestall future wider economic co-operation between the two countries. The best option therefore was to accept the Draft Agreement and work towards modifying it over time.

A few days later, that decision was rendered moot. The trigger was a letter dated July 11 from Mr Ismail on the status of a piece of land at Robinson Road in Singapore, the site of the proposed Singapore branch. The Malaysian view was that while the value of the land would be credited to the account of the Singapore branch, the title would remain in the name of Bank Negara Malaysia. Kuala Lumpur’s position was that the Singapore branch was not a legal entity and could therefore not own assets.

This was a bombshell. If the Singapore branch could not own property, that would mean it could not be the legal owner of its reserves.

Two days later, Mr Tan wrote to his Singaporean counterpart, noting Singapore’s reservations about the Draft Agreement but also adding that a decision was needed by the end of July, as the deadline for placing orders with the London printers for the new currency notes was mid-August. On August 4, Mr Lim flew to Kuala Lumpur to meet Mr Tan at his residence, carrying with him a formal letter of reply.

The letter stated clearly that Singapore would never place its reserves in trust with an agency under the control of a foreign government. It suggested two options. One was to place these reserves with an independent trustee like the IMF or the Bank of England. The other was to incorporate the office of the Deputy Governor overseeing the Singapore branch as a Corporation Sole, and for Singapore’s assets to be vested in him and not Bank Negara.

Mr Ismail replied that the Corporation Sole suggestion was unacceptable as it meant a separate legal entity, in effect a separate central bank. In a reply on August 8, Mr Tan also stated that Singapore’s proposals were not acceptable. He subsequently visited Singapore on August 13. At a meeting at Rumah Persekutuan, he was given a letter by Mr Lim, which reiterated Singapore’s stand that it could not be placed in a position where its reserves might be jeopardised. But Mr Lim expressed a willingness to explore “any alternative proposal” to resolve the impasse.

In a reply dated August 17, Mr Tan said the Draft Agreement did ensure that Singapore would have “the whole of the assets and liabilities shown in the books of Bank Negara Malaysia” in the event that the Agreement was terminated. He added: “Your real fear is that we may not honour that Agreement. The only answer to this is clearly to have no agreement at all”.

And so it came to pass that at 1.30pm on August 17, 1966, both governments announced to their peoples that Singapore and Malaysia would have separate currencies from June 12, 1967. Ultimately, the talks failed because Singapore did not receive ironclad guarantees it had indisputable rights over its reserves.

Subsequently, Malaysia and Singapore, together with Brunei, agreed to a Currency Interchangeability Agreement. The agreement allowed for the new Bruneian, Malaysian and Singapore currencies to be used as customary tender, fully interchangeable at par value, in all three countries. The agreement lasted till May 8, 1973.

The first separation had to be followed by a second.

http://www.straitstimes.com/singapore/second-separation-why-singapore-rejected-a-common-currency-with-malaysia

Singapore to stop issuing S$1,000 note to reduce money laundering risks

3 November 2020

Channel NewsAsia

Singapore will stop issuing S$1,000 notes from Jan 1 next year to reduce money laundering and terrorism financing risks, said the Monetary Authority of Singapore (MAS) on Tuesday (Nov 3).

From now until December, a limited quantity of S$1,000 notes will be made available each month.

“This is a pre-emptive measure to mitigate the higher money laundering and terrorism financing risks associated with large denomination notes,” said MAS, noting that large denomination notes allow individuals to carry large values of money anonymously.

“The move is aligned with international norms and major jurisdictions have already stopped issuing such large denomination notes.”

Existing S$1,000 notes in circulation will remain legal tender and can continue to be used as a means of payment. Banks can continue to recirculate existing $1,000 notes that are deposited with them, MAS said.

It added that other denominations will be made available “in sufficient quantities” to meet demand, particularly the S$100 note which is the next highest denomination. The public is also encouraged to use electronic payments such as PayNow and FAST.

Singapore stopped issuing S$10,000 notes in 2014, then one of the world’s most valuable banknotes.

“The development of more advanced and secured electronic payment systems has reduced the need for large value cash-based transactions,” MAS deputy managing director Ong Chong Tee had said.

https://www.channelnewsasia.com/news/singapore/singapore-to-stop-issuing-s-1-000-note-to-reduce-money-13449184